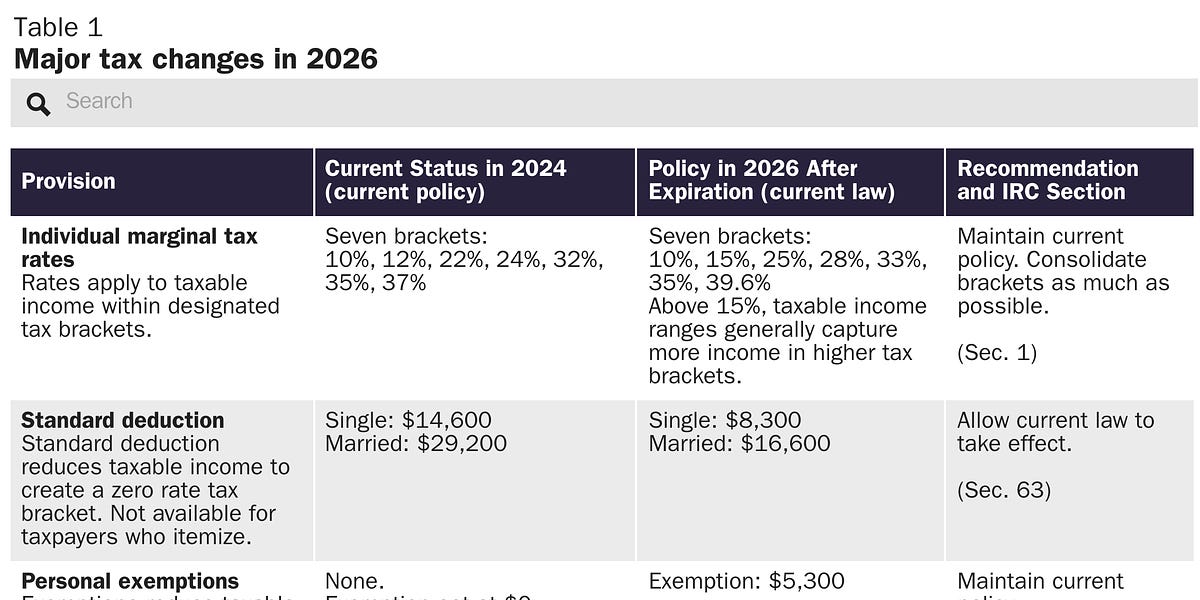

Tax Year End 2026. 10, 2025 — the internal revenue service today announced that the nation’s 2025 tax season will start on monday, jan. The expiration of tcja in 2026 will bring widespread changes to the u.s.

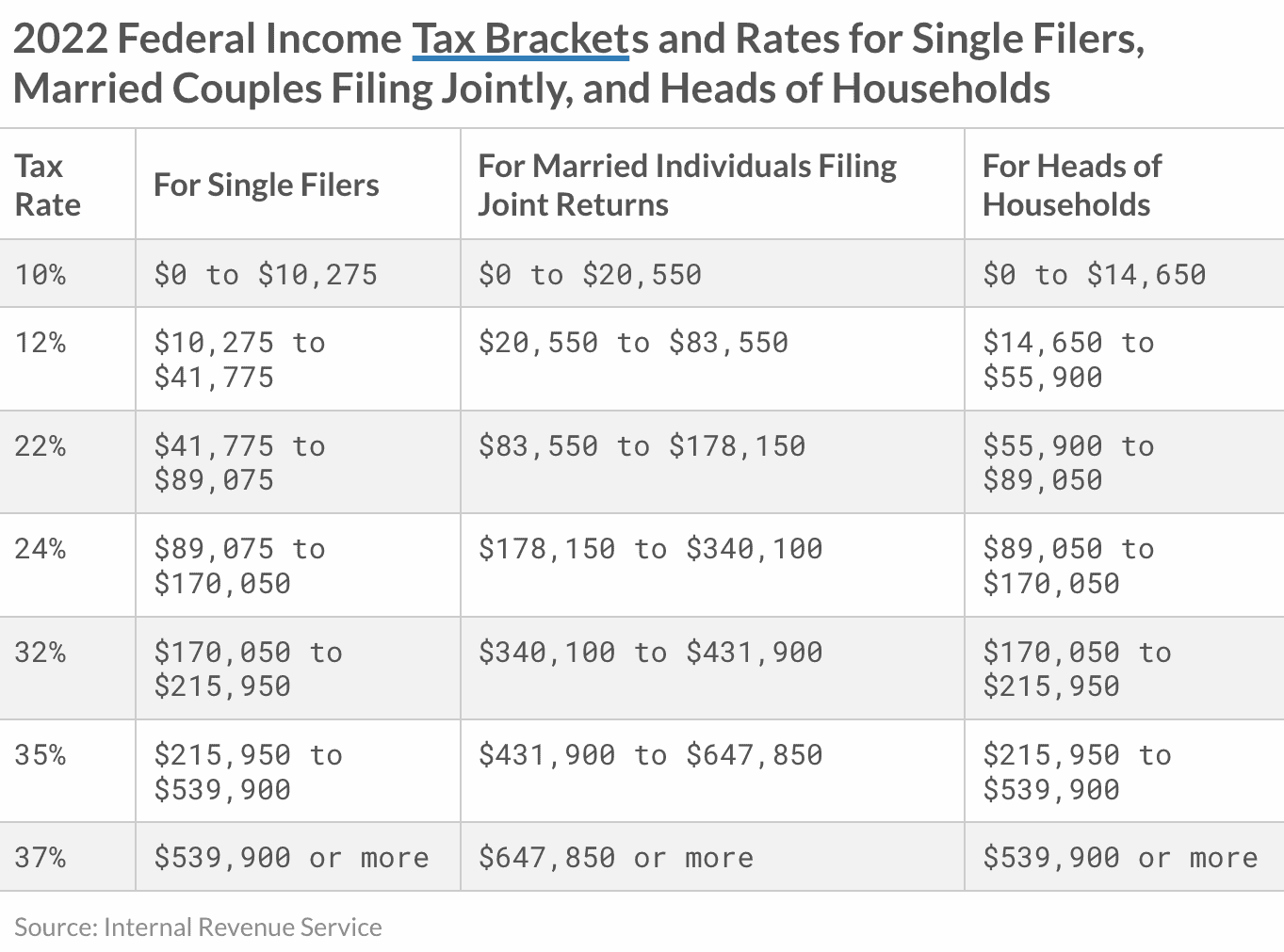

These tax rates are set to sunset. For single filers and heads of households age 65 and over, the additional standard deduction will increase slightly — from $1,950 in 2025 (returns you’ll file soon in early 2025) to.

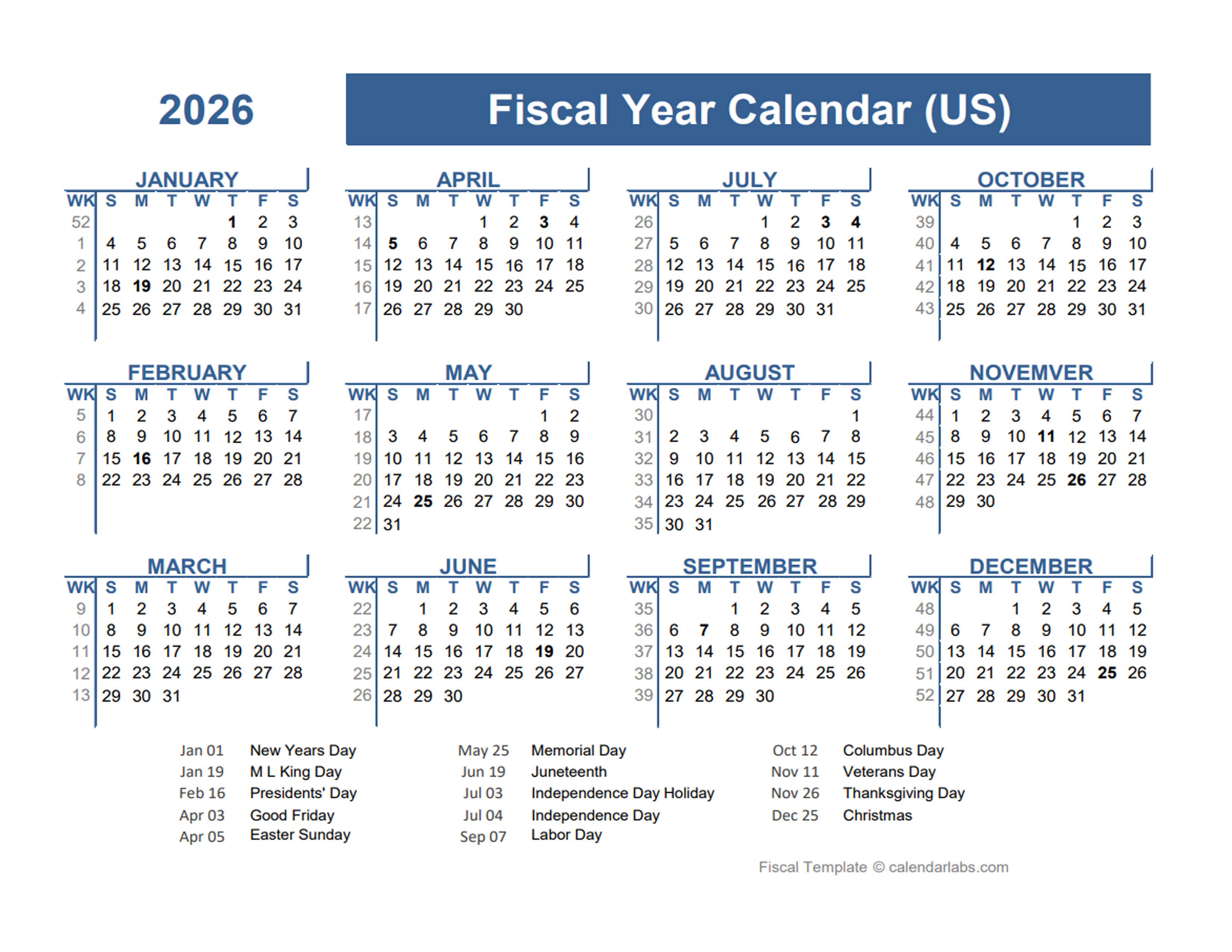

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive, Find a list of tax calculators and irs tax forms by tax year.

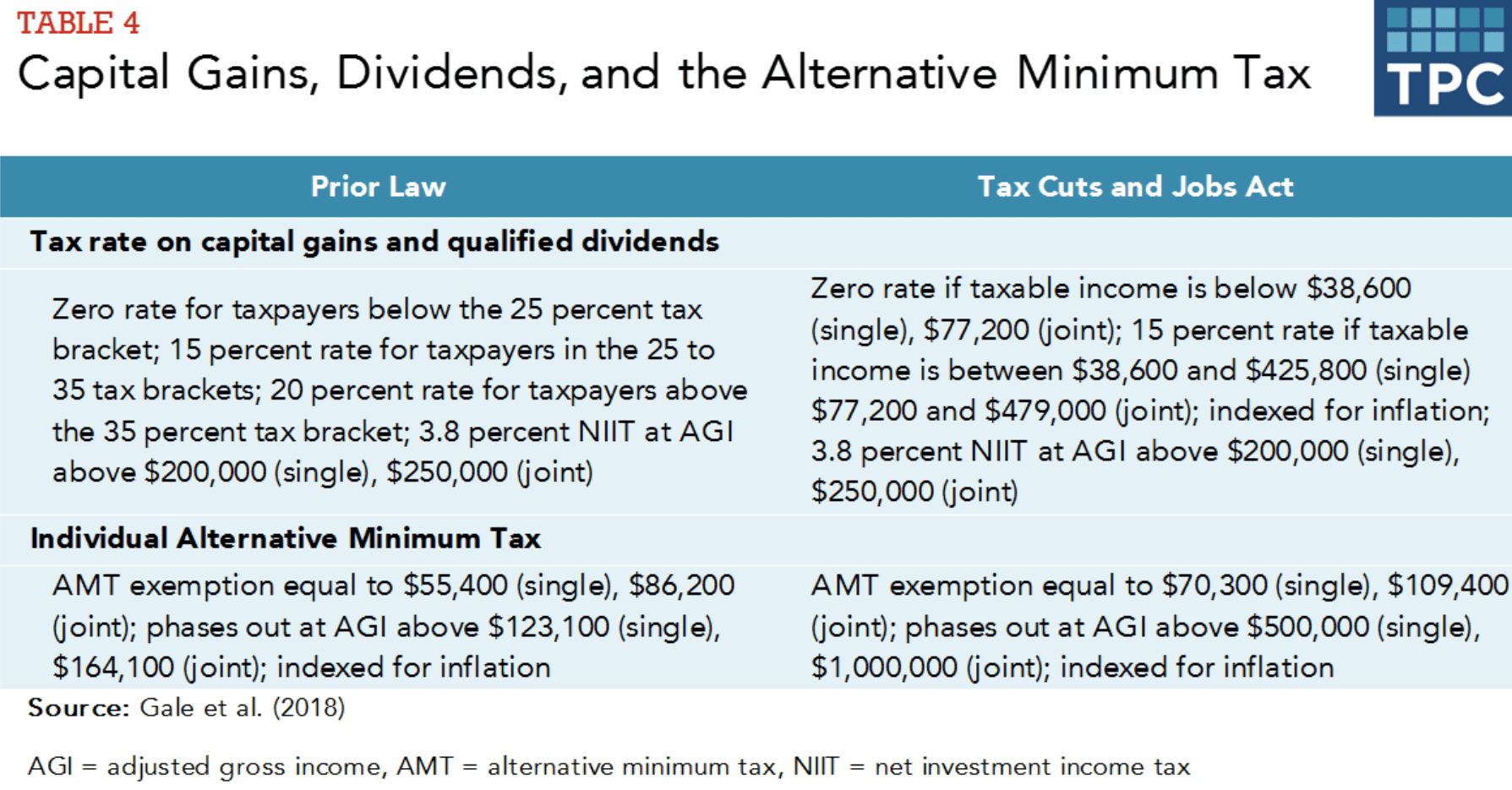

Tax Rates Sunset in 2026 and Why That Matters Modern Wealth Management, Learn about potential changes to 2026 tax brackets and why roth conversions are essential if the 2017 tax cut & jobs act (tcja) expires.

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, Big tax changes are likely coming in 2026.

Understanding the 2026 Tax Sunset Implications and Impact — Forty W, Average gasoline prices in 2025 will.

2026 Tax Increases in One Chart by Adam Michel, The current combined federal estate and gift tax exemption amount of $13.99 million per person ($27.98.

What Will The 2026 Tax Brackets Be? Cruise Around The World 2025, And, for many people, their tax burden will rise.

Navigating The Federal Pay Calendar For 2026 A Comprehensive Guide, Households could see tax rates revert to 2017 levels in 2026.

Navigating The Fiscal Year July 2026 June 2027 Calendar Of July, Most individual tax provisions were temporary.

2026 Tax Brackets Why Your Taxes Are Likely to Increase in 2026 and, I’ll break it down with three categories:

Tax Rates Sunset in 2026 and Why That Matters Barber Financial Group, The tcja lowered tax rates to 10%, 12%, 22%, 24%, 32%, 35%, and 37%.